Veteran trader Peter Brandt says Bitcoin (BTC) may plummet by about 50% from its current value – based on another commodity’s historic pattern.

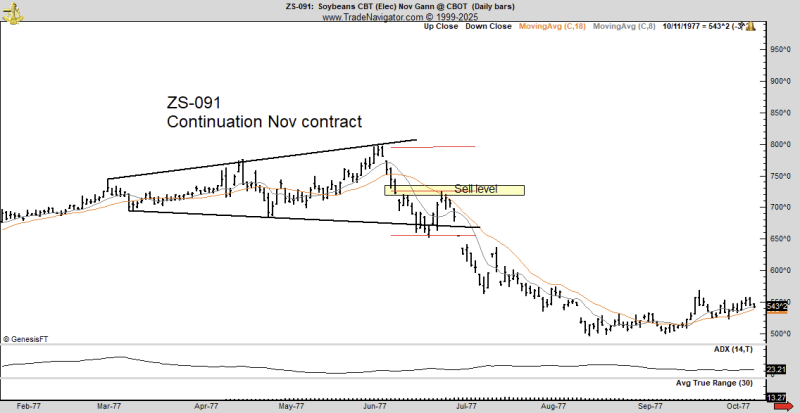

The legendary trader tells his 816,800 followers on X that Bitcoin may be printing a bearish broadening formation similar to the price of soybeans in 1977.

In technical analysis, a broadening formation is characterized by two diverging trend lines, one rising and one falling, leading to price volatility.

“In 1977 Soybeans formed a broadening top and then declined 50% in value. Bitcoin today is forming a similar pattern. A 50% decline in BTC will put [Strategy] MSTR underwater Whether I am right or wrong, you have to admit this old guy has the gonads to make big calls.”

Source: Peter Brandt/X

Source: Peter Brandt/X

Meanwhile, pseudonymous crypto trader Bluntz tells his 329,900 followers on X that Bitcoin is not done rallying this cycle.

“Same deal with BTC, one more all-time high then top, the current doomers are too early.”

Source: Bluntz/X

Bluntz practices the Elliott Wave theory, which states that a bullish asset tends to exhibit a five-wave rally, with waves one, three and five acting as upward moves and waves two and four serving as corrective periods.

Looking at his chart, the analyst suggests that Bitcoin is forming a fifth wave that may send the flagship crypto asset to about $140,000.

Bitcoin is trading for $108,132 at time of writing, down 4.2% on the day.

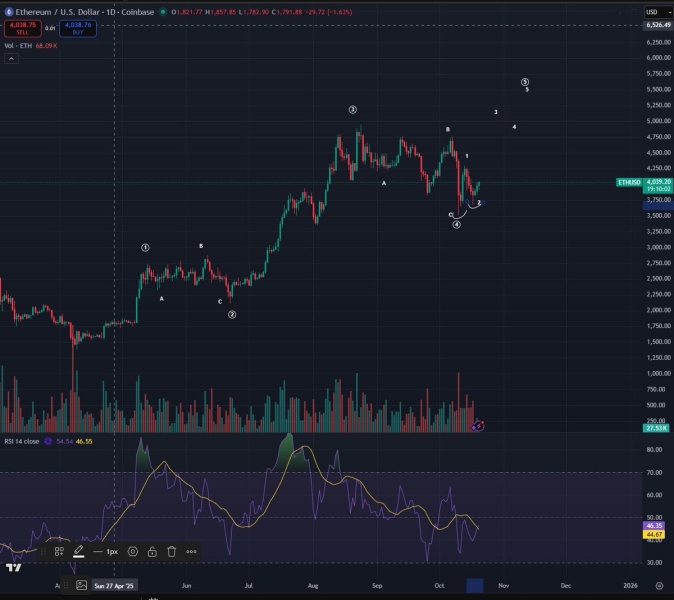

Bluntz also believes that Ethereum (ETH) will hit new all-time highs this cycle.

“Nice higher low [price] printed on ETH over the weekend, the doomers are a leg too early in my opinion. One more high and then top.”

Source: Bluntz/X

Looking at his chart, the analyst suggests ETH is forming the third wave of a five-wave rally. He predicts ETH will hit a high of about $5,500 before the end of the year.

ETH is trading for $3,841 at time of writing, down 4.6% on the day.