The president of sell-side Wall Street firm Yardeni Research says he’s seeing signs of a broadening bull market as momentum shifts to small and mid-cap (SMID) stocks.

Ed Yardeni says the ratio of the S&P 100 to the S&P 500 may have peaked at the end of last year.

“If so, then the odds of a bubble bursting now are much lower than they were back then, when the stock market was much more concentrated in tech names than it is now, according to this ratio.

So instead of a bursting bubble, we may be seeing a broadening bull market.”

Last month, Yardeni shifted to underweight on the Magnificent 7 stocks, arguing that the tech giants are now competing with one another in a “Game of Thrones” environment. The shift represented the firm’s first move away from being overweight on the sector in 15 years.

Yardeni says in his new analysis that the new thesis is working so far.

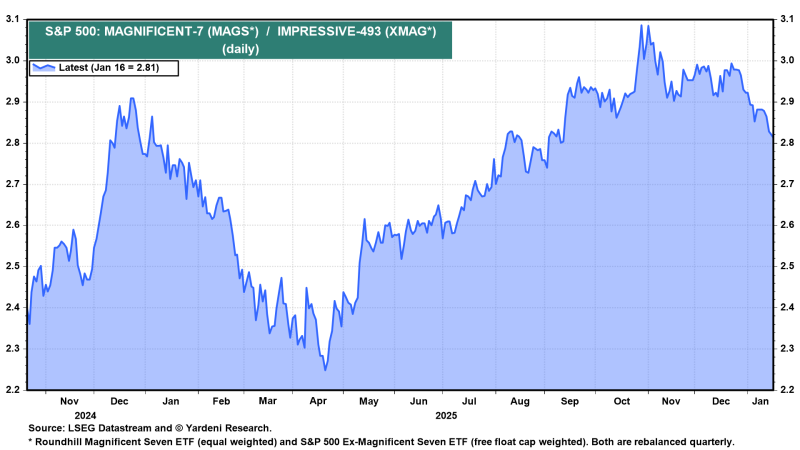

“Until late last year, the Magnificent-7 operated as seven independent kingdoms protected by large moats. Each prospered with its own unique monopoly. However, the AI arms race has upended that peaceful coexistence by greatly increasing competition among them. The ratio of the S&P 500 MAGS to XMAG ETFs peaked after Michael Burry famously tweeted on October 31, 2025, ‘Sometimes, we see bubbles. Sometimes, there is something to do about it.”

The Wall Street veteran notes that SMID stocks have outperformed large caps, though he acknowledges that this development could be a head fake.