Cryptocurrency analyst and trader Ali Martinez says one support level is currently the “most important” for Bitcoin (BTC).

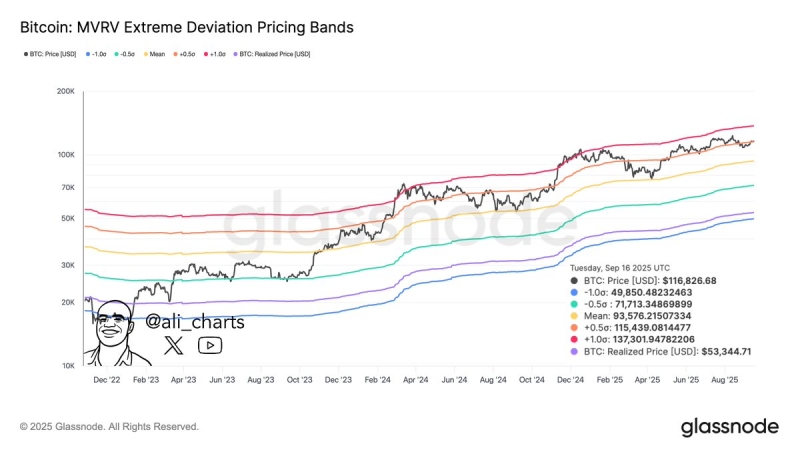

Martinez tells his 156,500 followers on X that, based on the MVRV (Market Value to Realized Value) Extreme Deviation Pricing Bands, the $115,440 support level could determine whether Bitcoin hits a new all-time high or plummets to lows last recorded in May.

MVRV (Market Value to Realized Value) Extreme Deviation Pricing Bands are a tool in on-chain analysis used to identify potential market tops and bottoms.

Martinez says that if the $115,440 support level holds, Bitcoin could go up by around 17% from the current level. Bitcoin could, however, plummet by around 20% if the support level crumbles, according to Martinez.

“Hold it, and $137,300 is next.

Lose it, and $93,600 comes into play.”

Source: ali_charts/X

Bitcoin is trading at $117,150 at time of writing.

According to Martinez, Bitcoin is witnessing an increase in the number of long positions while the open interest, which is an indication of swelling market speculation, is also rising. This is happening at a time when Bitcoin is facing major resistance, Martinez says.

These conditions, per Martinez, pose the “risk of a long squeeze ahead.” A long squeeze occurs when leveraged long positions encounter a price crash, which forces them to sell and thus creates a series of cascading liquidations.

Source: ali_charts/X

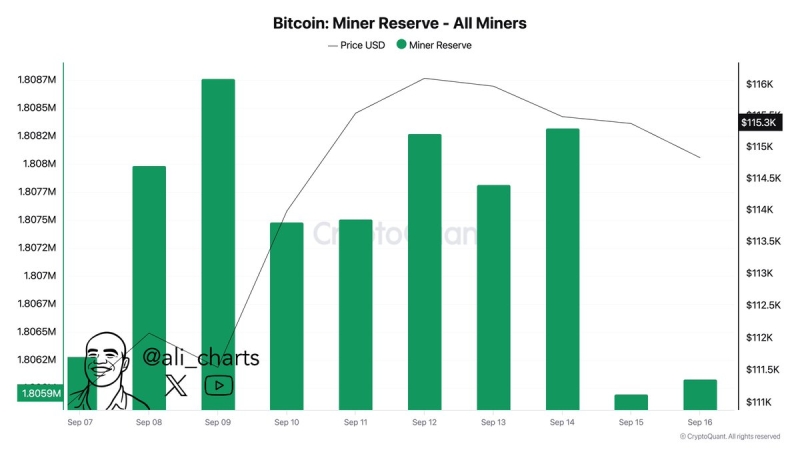

Citing analytics firm CryptoQuant’s data, Martinez further says that over the past three days, Bitcoin miners have disposed of BTC worth more than $234 million.

“Miners sold over 2,000 Bitcoin in the past 72 hours!”

Source: ali_charts/X