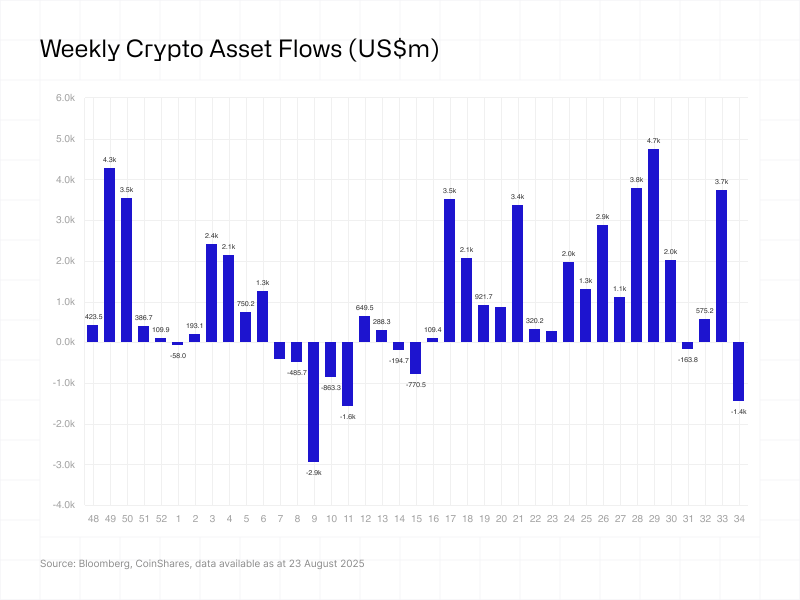

Digital asset investment products saw their largest weekly outflows since March, as skepticism over Federal Reserve monetary policy weighed heavily on sentiment.

In its latest Digital Asset Fund Flows Weekly Report, CoinShares says that institutional investors pulled $1.43 billion from crypto investment vehicles last week, with exchange-traded product (ETP) trading volumes surging to $38 billion – roughly 50% above this year’s average.

“Digital asset investment products recorded their first significant outflows in weeks, totalling US$1.43bn, the largest since March. Early in the week, pessimism around the Federal Reserve’s stance drove outflows of US$2bn. However, sentiment shifted later in the week following Jerome Powell’s address at the Jackson Hole Symposium, which was widely interpreted as more dovish than expected, sparking inflows of US$594m.”

Source: CoinShares

Bitcoin (BTC) investment vehicles led the outflows, shedding $1 billion last week. Ethereum (ETH), however, showed relative resilience.

“This shift in tone was more strongly reflected in Ethereum than in Bitcoin. Ethereum saw a sharp mid-week recovery, limiting outflows to US$440m compared to Bitcoin’s US$1bn. Month-to-date figures now show inflows of US$2.5bn into Ethereum, while Bitcoin has experienced net outflows of US$1bn.”

Sui (SUI) and Ton (TON) saw outflows of $12.9 million and $1.5 million.

Blockchain intelligence firm Lookonchain notes that BlackRock also made a massive Bitcoin deposit into Coinbase Prime, presumably to sell on the open market. Citing Arkham data, Lookonchain reports that BlackRock sent 1,703 BTC worth $190 million into Coinbase.

And according to a report from pseudonymous on-chain analyst Sani, a mystery BTC whale liquidated its entire 24,000 BTC balance, currently worth $2.7 billion, further contributing to sell pressure.