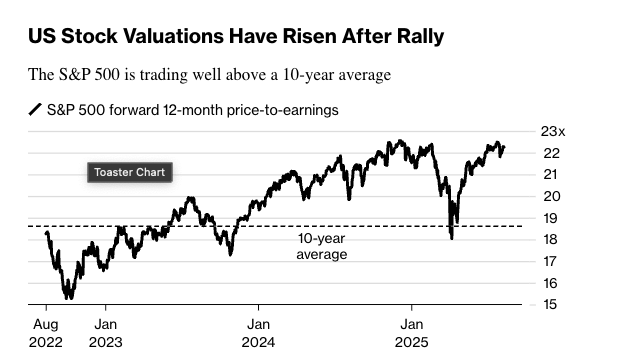

Over 90% of fund share managers, a new record, reportedly think that the US stock market is overvalued, according to a Bank of America (BofA) survey.

Per a new Bloomberg report, 91% of polled fund managers think US stocks are overvalued, the highest rate since 2001.

BofA’s poll also found that investor allocation in foreign markets has climbed to its highest weight since February, signalling a potential sentiment shift on US markets.

BofA strategist Michael Hartnett warns that the recent stock market rally may be at risk of turning into a bubble, especially given that the bank’s survey showed that cash levels as a percentage of total assets were at 3.9% – a level that has historically signalled an incoming sell-off.

Source: Bloomberg

On the contrary, a net 49% of respondents believe that emerging market (EM) stocks are undervalued, the most since February of 2024. Among the most “crowded trades,” the most popular answers were long the Magnificent 7 stocks, short the dollar, and long gold.

Respondents said that the biggest tail risks for markets include a trade war-induced recession, runaway inflation preventing Fed rate cuts, “disorderly rise” in bond yields, an artificial intelligence (AI) equity bubble and dollar debasement.