BitMEX co-founder Arthur Hayes believes one catalyst could suddenly send Bitcoin (BTC) to new all-time highs amid US President Donald Trump’s tariff policies.

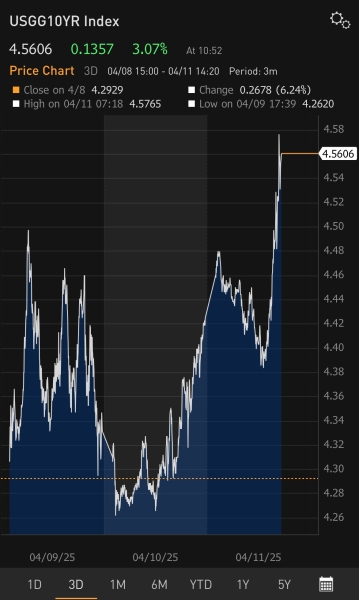

Hayes tells his 679,700 followers on the social media platform X that the sudden selling-off of US treasuries and rising 10-year bond yields is likely to result in the printing of more money, which has ignited massive Bitcoin rallies in the past.

“It’s on like Donkey Kong. We will be getting more policy responses this weekend if this keeps up. We are about to enter UP ONLY mode for BTC.”

Source: Arthur Hayes/X

Hayes also believes that the weakening of China’s yuan due to central bank money printing may cause investors to move their wealth into Bitcoin as a hedge.

“No deal. PBOC (People’s Bank of China) continues a very gradual yuan weakening. Sh*t ’bout to get spicy. Luckily, BTC loves money printing and associated CNY (Chinese yuan) weakness.”

Lastly, Hayes says that banks will likely be granted a Supplementary Leverage Ratio (SLR) exemption being advocated for by JPMorgan Chase CEO Jamie Dimon. The exemption would allow banks to hold more Treasuries without increasing required capital reserves, giving banks more liquidity to lend.

“What Jamie Dimon wants, Jamie Dimon gets. SLR exemption is what we need to send BTC orbital.”

Bitcoin is trading for $83,343 at time of writing, up 4.9% in the last 24 hours.