The most successful asset of the last 15 years is once again annihilating the doubters.

In the last hour, a total of $687.22 million in Bitcoin shorts have been liquidated, according to the crypto data aggregator CoinGlass.

The shorts have provided rocket fuel for a sudden move above $116,000.

BTC began the day at around $111,000, and is up 4.7% in the last 24 hours.

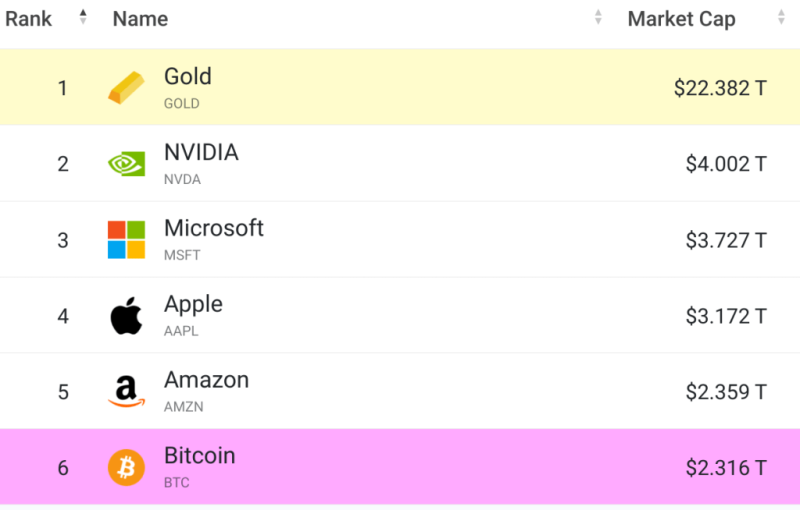

This week’s rally has placed BTC’s total value above tech giant Google, with only Amazon, Apple, Microsoft, Nvidia and Gold remaining in front.

Source: Companiesmarketcap.com

The rally also once again places BTC closer in line with M2 global liquidity, which measures the total money supply, including cash, checking deposits and easily convertible near-money assets.

Although no one knows what’s next Bitcoin, macro analyst Martin Folb is sharing an updated map of BTC’s price against global liquidity.

He tells his 219,000 X followers that BTC has officially moved past a key accumulation zone.

“Wyckoff Accumulation is officially over. Distribution begins as price follows global liquidity to $125k on way to $160k. I will be posting the next Wyckoff Distrubition to reacculuation schematic in confirmation.”

Source: Martin Folb (MartyParty)/X

Wyckoff Accumulation is a technical analysis pattern that strategically tracks an asset during an extended consolidation phase, using price and volume behaviors to identify when supply at lower prices is absorbed.