Bitcoin (BTC) stands above other crypto assets amid the ongoing economic turbulence, according to the digital asset investment management firm NYDIG.

Greg Cipolaro, the global head of research at NYDIG, notes in a new analysis that crypto markets have remained largely stable despite the “carnage” in traditional financial markets.

“Perpetual swap rates have been persistently positive. Liquidations spiked on Sunday and Monday [last week], but the two-day total of $480 million was well below other notable liquidation events. The basis on on-shore and off-shore futures has remained positive. Finally, the price of USDT, while below $1.00, has not experienced a sharp decline.

Historically, in broad risk-off moves, we tend to see stresses show up in crypto markets. We have yet to see that.”

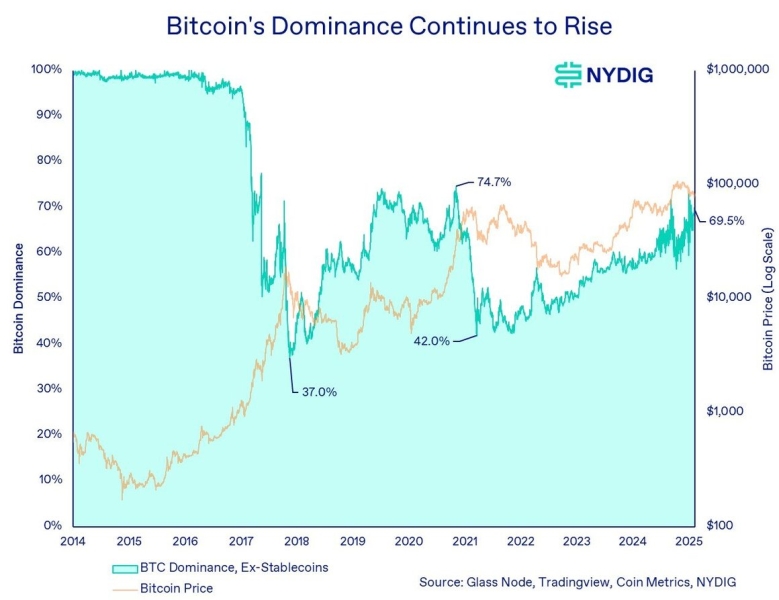

Cipolaro notes Bitcoin has largely fared better than Ethereum (ETH) and other altcoins, noting that BTC remains the number one hedge against currency debasement.

“The ETH-BTC cross continues to plumb levels not seen since 2019, for example, and many other cryptocurrencies have yet to find their footing in this volatile environment.

In a world of global uncertainty and a loss in faith of fiat currencies and sovereign nations, there does not appear to be a second-best option to fiat debasement.”

Source: NYDIG

BTC is trading at $84,984 at time of writing.