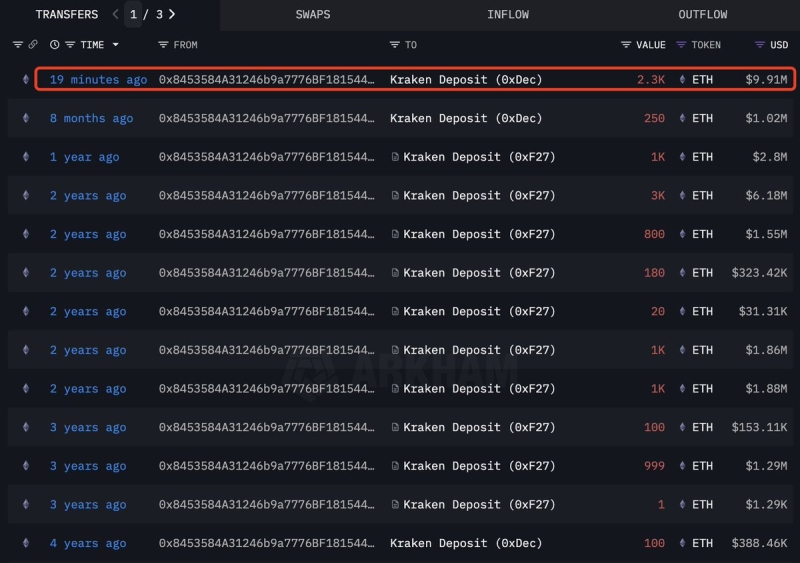

One trader who participated in Ethereum’s (ETH) initial coin offering (ICO) has moved some of the funds to the US-based crypto exchange Kraken to sell on the open market.

According to blockchain intelligence firm Lookonchain, the ICO participant recently sold nearly $10 million worth of ETH.

“An Ethereum ICO participant who received 20,000 ETH (cost $6,200, now $86.6 million) just sold another 2,300 ETH ($9.91 million), leaving him with 1,623 ETH ($6.99 million).”

Source: Lookonchain/X

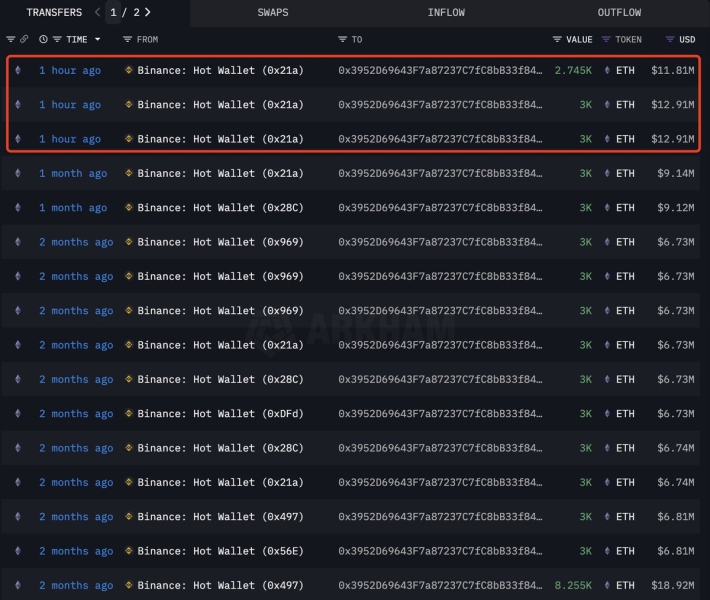

Furthermore, Lookonchain says that another smart contract platform whale has over $100 million worth of unrealized profits after accumulating tens of thousands of Ethereum on Binance.

“Whale 0x3952 withdrew another 8,745 ETH ($37.6 million) from Binance…

Over the past two months, this whale has withdrawn 65,001 ETH ($281 million) from Binance at an average price of 2,611 – now sitting on over $111 million in unrealized profits.”

Source: Lookonchain/X

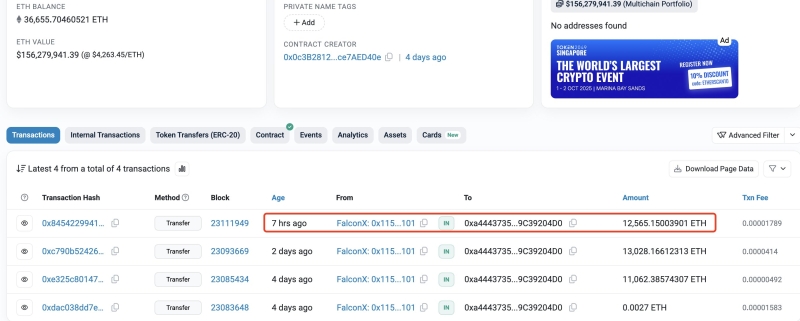

Finally, Lookonchain says a ‘mysterious institution’ has accumulated over $200 million in ETH just recently.

“This mysterious institution accumulated another 49,533 ETH ($212 million) today.

Over the past week, they have accumulated 221,166 ETH($946.6 million) from FalconX, GalaxyDigital and BitGo.”

Source: Lookonchain/X

Earlier today, Lookonchain found that one investment firm is down hundreds of millions of dollars after attempting to short multiple major cryptos.

In a post on the social media platform X, Lookonchain says that crypto asset manager Abraxas Capital – a firm with around $3 billion in assets under its management – tried to short top cryptos as a hedge on its other positions.