A widely followed crypto analyst believes Bitcoin (BTC) is primed to defy expectations early next year.

Crypto trader Michaël Van De Poppe tells his 816,000 followers on X that institutional players are about to change the game.

“Do you really think that institutions are going to wait placing positions on the best asset on this planet, BTC, because of some Web 3 4-year cycle type of theory?

Do you really think that a Web 3 founder, building the next era of decentralized finance, cares about the 4-year cycle more than mass adoption after the approval of the Genius (and hopefully Clarity act)?

Of course not. A lot of Web 3 people think that Web 3 is the only thing that exists in this ecosystem. That’s behind us.

Institutions have come. Bitcoin has become a mature asset.

Bitcoin is the best form of money ever existed, that’s why more and more players are forced to adopt Bitcoin as it’s simple game theory.

No, that doesn’t mean that we’re going to see the same 4-year cycle repeat again.

The markets have seen a harsh, but relatively regular correction and are about to surprise everyone and their cat in Q1 2026.”

According to Van De Poppe, BTC is primed to explode after one last dip.

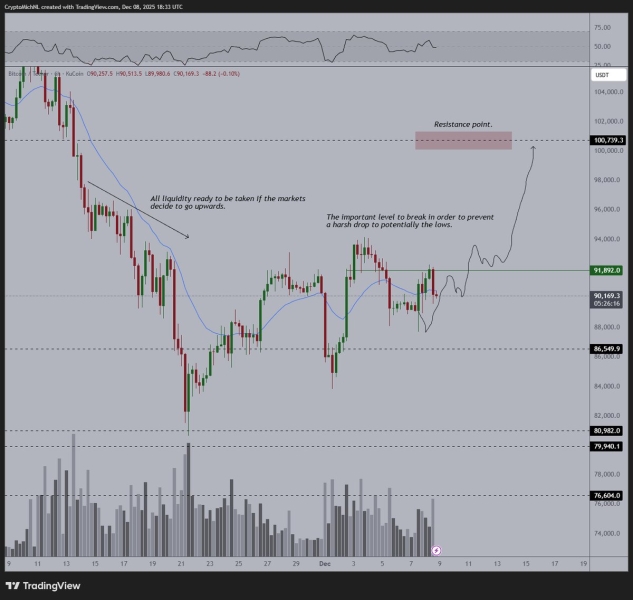

“The $92,000 level is the crucial level for Bitcoin.

Relatively harsh rejection has taken place, which means that it doesn’t look great in the short-term.

I would love to see this breakout occur, and it remains a scenario, however, given all the lows looking at me in the eyes, I wouldn’t be surprised if we get a standard approach like this:

Jerome Powell comes out and remains to be hawkish and says ‘I don’t know whether we’ll proceed with rate cuts’ and the entire does a classic sell-off the news type of correction.

This would mean, the markets sweep those lows a final time in 2025, crash to $78-82K and reverse quickly from there.

I think those two scenarios are my scenarios going into FOMC.”

Source: Michaël Van De Poppe/X

BTC is trading at $90,165 at time of writing, down 12% in the last 30 days.