Uncertainty is driving gold’s price momentum, according to analysts at the capital markets newsletter The Kobeissi Letter.

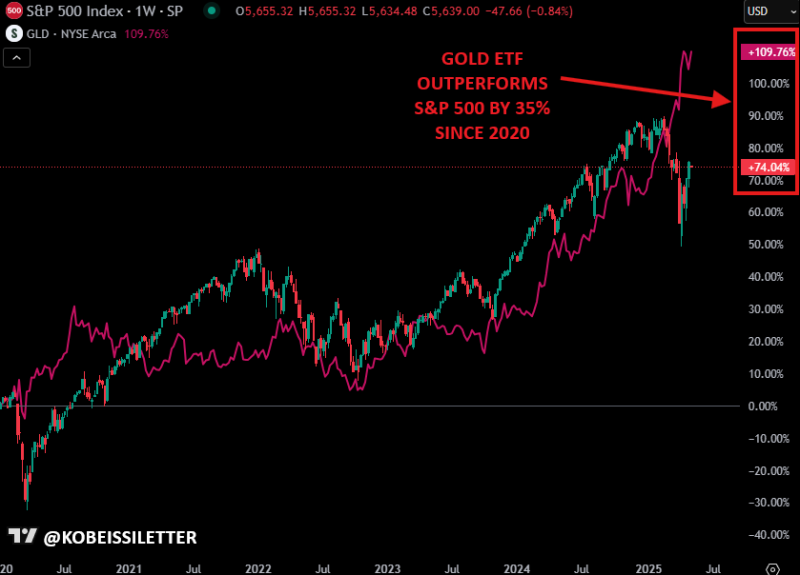

The Kobeissi Letter’s official account on the social media platform X notes that heading into this year, gold had been underperforming the S&P 500 by approximately 10% since 2020.

“However, as uncertainty has risen, GLD is now up +109% since 2020 compared to +74% in the S&P 500. But, why are gold prices surging even as the market recovers? Uncertainty remains the answer.”

Source: KobeissiLetter/X

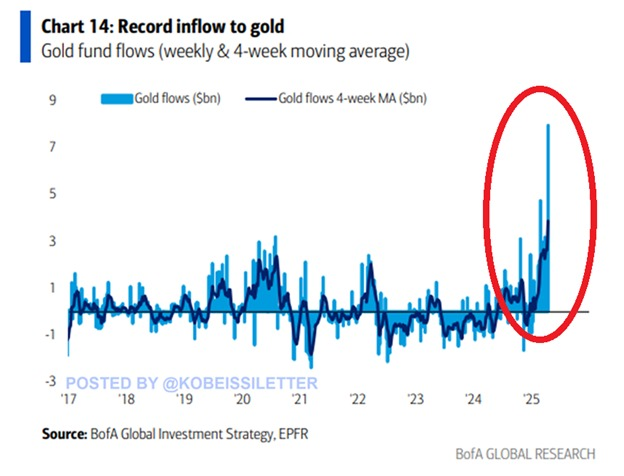

The analysts also note that gold funds witnessed approximately $8 billion in net inflows three weeks ago, a record-setting total they say suggests “a continued flight to safety.”

“As a result, the four-week moving average of inflows jumped to ~$4 billion, also an all-time high. This is likely the strongest gold market of all time.”

Source: KobeissiLetter/X

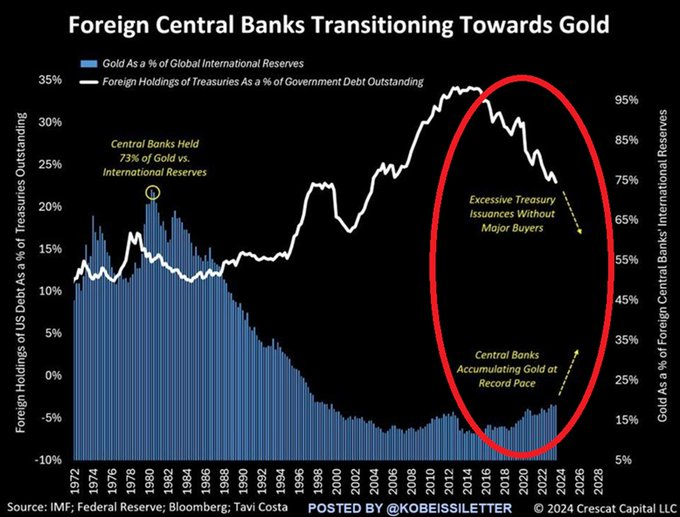

They also say central bank buying remains “historically strong.” The newsletter notes that foreign holdings of Treasuries as a percentage of US government debt have fallen to approximately 23%, the lowest in more than two decades.

The analysts, citing data from macro strategist Otavio Costa, also note that gold holdings as a percentage of global reserves have surged to approximately 18%, the highest in 26 years.

Source: KobeissiLetter/X

The Kobeissi Letter also points out that the US Dollar Index (DXY) recently plunged to a 52-week low. The DXY measures the strength of the USD against a basket of other major foreign currencies.

“The US Dollar, DXY, has weakened by nearly 10% since the trade war began. A weaker dollar makes USD-denominated gold cheaper for foreign investors. Gold is almost serving as a leading indictor for tariffs.”

Source: KobeissiLetter/X