- WORLD EDITION North America Australia World

- My INN

VideosCompaniesPress ReleasesPrivate PlacementsSUBSCRIBE

- Reports & Guides

- Market Outlook Reports

- Investing Guides

Resource

TechLife Science Battery Metals MarketBattery Metals NewsBattery Metals Stocks

Analyst Spotlight: Castle Minerals' Path to Significant Gold Discovery in Ghana

A recent research report by Terra Studio highlights Castle Minerals’ (ASX:CDT) investment value proposition as a gold exploration company with significant potential in Ghana's gold-rich region. With an enterprise value of just AU$3.4 million, Terra Studio considers Castle Minerals significantly undervalued given its promising drill results, strong government support for its graphite project, and potential for continued discoveries amid record-high gold prices.

The Terra Studio report from April 14, 2025, outlines several compelling reasons why Castle Minerals presents an attractive investment opportunity.

investingnews.com

Key Highlights from the Report:

Strategic Location and Recent Discoveries

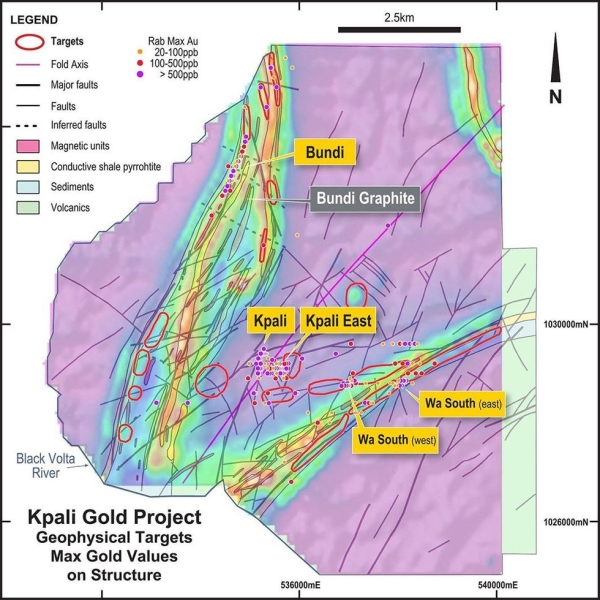

Castle's projects are located in northern Ghana, which hosts several major gold deposits including Cardinal Resources' 5.1 Moz Namdini deposit. The company's Kpali gold project has confirmed robust mineralization with impressive drill results including 12 m at 8.29 grams per ton (g/t) gold and 9 m at 4.81 g/t gold, while the Kandia gold project has demonstrated promising continuity with results like 7 m at 3.36 g/t gold.

Geological Advantage

The report emphasizes that Castle's Kpali area sits at the convergence of two major fertile greenstone belts and three regional-scale structures that host multi-million-ounce deposits in the region – a geological setting similar to higher-valued projects in West Africa.

Strong Leadership and Financial Position

The company is led by Stephen Stone, who previously grew the nearby Black Volta gold project to 2.80 million ounces of mineral resources. Following a recent AU$3 million placement, Castle Minerals is well-funded to continue its exploration activities.

Additional Value in Graphite

Castle also owns the Kambale graphite project, one of the highest-grade graphite projects in Africa with a mineral resource of 22.4 million tonnes at 8.6 percent total graphitic carbon. The Ghanaian government has expressed strong support, with the country's sovereign fund signing a term sheet to invest approximately US$2 million to advance the project.

For the full analyst report, click here.

This content is intended only for persons who reside or access the website in jurisdictions with securities and other applicable laws which permit the distribution and consumption of this content and whose local law recognizes the scope and effect of this Disclaimer, its limitation of liability, and the legal effect of its exclusive jurisdiction and governing law provisions [link to Governing Law section of the Disclaimer page].

Any investment information contained on this website, including third party research reports, are provided strictly for informational purposes, are general in nature and not tailored for the specific needs of any person, and are not a solicitation or recommendation to purchase or sell a security or intended to provide investment advice. Readers are cautioned to seek the advice of a registered investment advisor regarding the appropriateness of investing in any securities or investment strategies mentioned on this website.