Impact Minerals Limited (ASX:IPT) is pleased to announce the acquisition of a large, 675 sq km landholding adjacent to its current land position surrounding one of the world’s greatest mines containing over 350 million tonnes of massive sulphide mineralisation, the Broken Hill silver-lead-zinc deposit in New South Wales.

- Impact to acquire a large tenement package from New Frontier Minerals Limited (ASX:NFM) adjoining its existing ground holding that almost completely surrounds the giant Broken Hill lead-zinc-silver mine in New South Wales.

- Impact’s ground now extends over 1,770 sq km and covers an area considered extremely prospective for large copper deposits following a novel exploration model that formed the basis of the company’s participation in the inaugural BHP Xplor program in 2023.

- Detailed mapping and sampling of 99 gabbro sills and other work completed during the Xplor program confirmed the copper potential with numerous areas for further exploration identified within the Broken Hill sequence. At least one such target lies within the newly acquired ground.

- Next steps will include ground geophysics to help identify targets for drilling.

- Terms of the acquisition are as follows: Impact to purchase BHA No 1 Pty Ltd, a wholly owned subsidiary of NFM, for $275,000 in Impact shares and subject to staged voluntary escrow over six months commencing one month after Completion.

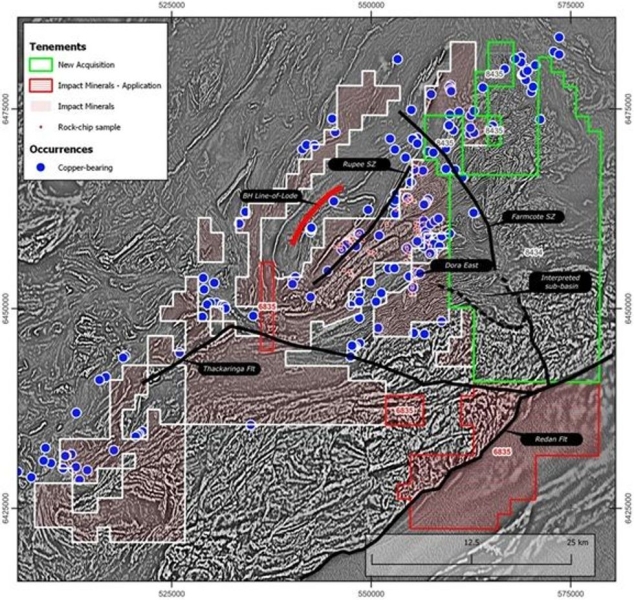

The acquisition builds on exploration and research completed as part of the BHP Xplor program, in which Impact participated in its inaugural year, and positions the company as one of the largest ground holders in the region, particularly to the south of Broken Hill. Impact now has 100% ownership of tenements covering 1,770 sq km and over 100 kilometres of strike (Figures 1 and 2; ASX Releases January 17, 2023, and February 16, 2023).

The Broken Hill region is currently experiencing a resurgence of interest in exploration. Broken Hill Mines (ASX: BHM, formerly Coolabah Metals Limited) recently purchased the privately owned Rasp Mine in Broken Hill and the nearby Pinnacles deposit. In addition, South32 Limited has entered a joint venture with a private company that owns a significant ground holding north of the Broken Hill mine. This interest is partly driven by a recent increase in silver prices and long-term demand trends for zinc and lead.

The Search for Copper at Broken Hill

Since the discovery of the giant Broken Hill deposit in 1883, most previous exploration has focused on silver-lead-zinc mineralisation. However, various styles of copper mineralisation are also known to occur throughout the region and have been the focus of some exploration and shallow drilling, though with limited success (Figures 1 and 2). Since copper mineralisation is commonly associated with, but peripheral to, numerous silver-lead-zinc deposits, many exploration geologists have asked, “Where is the large copper deposit at Broken Hill?”.

Figure 1. Image of regional total magnetic intensity showing the Broken Hill orebody (Line of Lode), Impact’s granted licences and licence applications and the new tenements acquired. Note the Thackeringa Fault and Farmcote shear zone, both interpreted as deep-seated long-lived crustal lineaments, and the interpreted sub-basin in the new tenements. Widespread copper occurrences attest to the prospectivity of the region for copper. Impact’s rock chip locations are also shown.

Figure 2. Image of the first vertical derivative of regional magnetic data as in Figure 1. A detailed interpretation of this data has resulted in the identification of numerous target areas for large copper deposits.

Impact became interested in the region's copper potential during exploration for silver-lead- zinc at the Dora East prospect, located about 30 km south of Broken Hill (Figures 1 and 2). Here, Impact discovered moderate widths of high-grade silver-lead-zinc mineralisation and narrow zones of high-grade copper-silver mineralisation (Figure 3 and ASX Releases December 8, 2015, and February 19 2016).

This article includes content from Impact Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.